Inflation is rising worldwide, putting strain on businesses and individuals. Built environment professionals, such as architects, surveyors and engineers, will not escape the impact of inflation.

In our latest article, we provide guidance on how to manage and mitigate inflation on architecture and design projects – providing clear steps you can take to reduce the overall impact on your business.

How does inflation affect the design profession?

Inflation is one component of an overall tighter economic climate in which projects may be scaled back, put on hold or mothballed. But it also has a direct impact on profit margins and costs. In addition, managing costs in an inflationary environment is unpredictable, making it more challenging to budget for projects and agree upon realistic fees.

Pricing Structure

Most architectural, engineering and surveying engagements are based on a fixed fee structure. This means that the fee for the whole project is agreed upon and fixed as the project begins. This fee will be based on a range of factors, not least the cost of labour and overheads at the time that budgets were determined.

Construction projects typically run for 12 to 24 months and longer in some cases, creating plenty of potential for the initial pricing to quickly become out of date. In high inflationary environments, this differential can be significant for the project's overall profitability.

Overheads/Costs

Architectural, engineering and surveying firms have a range of expenses, all of which will be impacted by inflation in several different ways.

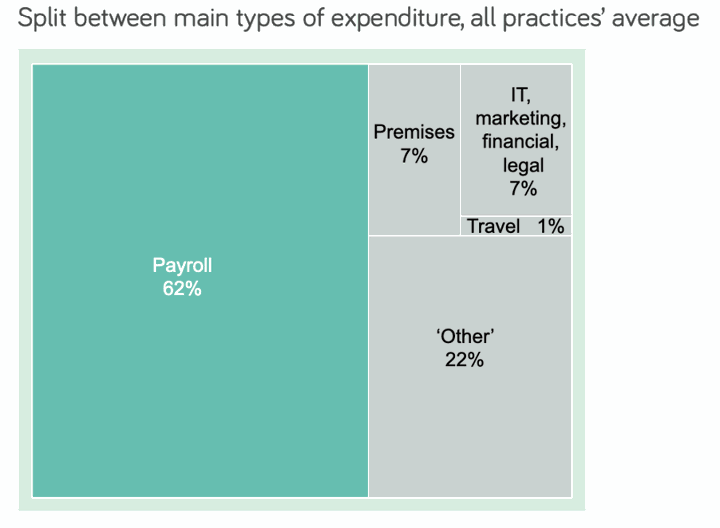

The largest cost element for firms is wages, with payroll representing around 62% of total costs. IT and marketing represent 7%, as do the premises' costs. Travel only represents 1% of costs, with 22% comprising other elements.

The ability to save money on travel by switching to virtual meetings is therefore limited due to its relative insignificance to the total overhead costs.

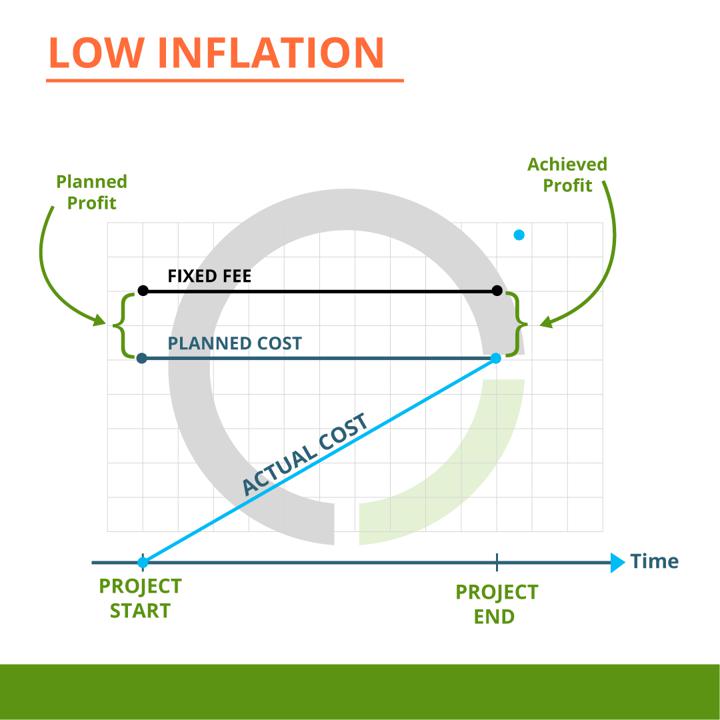

In low inflationary environments, we can have a good feel for what our project input costs will be in one or two years' time. The current going rate of pay will be understood and accounted for. This is important as payroll represents the most significant cost by a considerable margin.

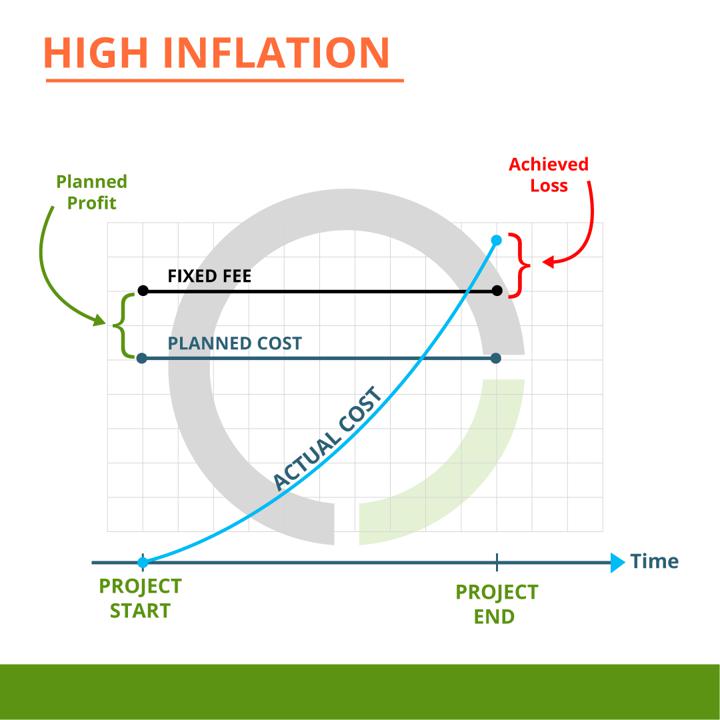

In a high inflationary environment, there will be upward pressure on salaries, which, if they cannot be met, can result in the loss of key staff. As a result, we should expect all costs to rise over time. While costs such as office rent can be contractually agreed upon in advance, other elements such as heating and lighting in the office may increase considerably.

Profit margins & The Impact of Inflation

Inflation adds unpredictability to the costing process, meaning prices quoted at the beginning of the project may be too low within a matter of months. In a high inflationary environment ensuring project profitability will be challenging.

Profit margins in our industry typically range between 10-20%. This is relatively narrow and means that rising inflation may endanger profitability. This can be particularly pronounced for larger practices working on bigger projects. These larger practices typically generate a much larger revenue, but at smaller margins.

The extended timescales associated with larger projects make them more vulnerable to rising prices. Add the perennial challenges associated with scope creep, and the profitability of projects can soon be undermined.

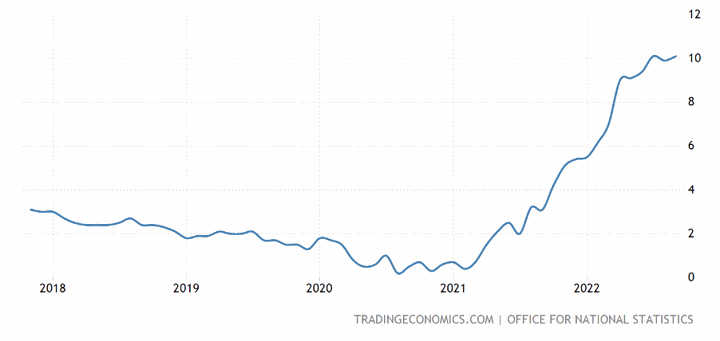

Inflation in the UK is currently above 10%.

Real-world Scenario of the Impact of Inflation

Let’s look at a financial example of how inflation can impact a project.

If at the proposal stage of a two-year project, a cost of £500,000 has been calculated, the impact of inflation at 10% will add £25,000 to those costs after 12 months. After 24 months, these added costs will be £75,000.

Assume that a 10% profit margin was targeted at the outset (ie a fee of £550,000). This will be reduced to 5% by the end of 12 months. After 24 months, a 10% profit becomes a 5% loss as a result of the impact of inflation.

It’s clear to see that inflation can have a pernicious effect on profit margins and the overall viability of practices.

So what can be done to help protect profits in an inflationary environment while remaining competitive?

How to inflation-proof your profits

There are a number of steps that architects can take to negotiate the challenges of an inflationary environment.

Here are the three main options:

Option1: Work on a pure hourly rate basis

Perhaps the most straightforward way to cope with an inflationary environment is to work on a pure hourly rate basis. This means that you can make it clear that rates may rise as a result of inflation during the timeline of the project.

This can create a transparent and easy-to-understand pricing structure as long as potential rises in the hourly rate are agreed from the beginning (i.e. don’t fix the billing rates for the full term). Both the professional and client need to be clear that the contract will allow for a rate review.

However, working on a pure hourly basis has its limitations. Clients may be unwilling to accept an hourly rate on anything other than the smallest of projects. Moreover, this approach places the risk entirely with the client, and they may be reluctant to shoulder all of the potential liability in an inflationary environment.

As very small projects are shorter in length than the average project, the impact of inflation may be less keenly felt.

Option 2: Estimate the impact of inflation and add this to the initial fee.

Another option is to estimate the impact of inflation and then add this to the initial fee quoted. This can protect against the risk of inflation, but it can be challenging to get right.

Predicting where inflation will be in the next few months, never mind a year or two’s time, can even be challenging for economists. A range of factors will impact inflation, and trends can be ascertained, but unexpected events can change those trends suddenly.

While predicting the economic future can be difficult, this approach does have some advantages. It spreads the risk between the professional and the client, and even if prices do rise, you have at least mitigated the drop in profitability.

Option 3: Link the fee to published inflation rates

Another approach is to link the fee to published inflation rates. This removes the element of guesswork and can reduce the potential for disagreement. Usually, a base fee will be agreed upon based on costs as they currently are. It’s then agreed that monthly invoices will include an inflation-linked uplift.

This reduces all risk to you but does mean that the client may end up paying more. As they are shouldering all the risk regarding how fees are calculated, using this method needs to be clearly established and agreed upon.

Inflation Calculator: Calculating inflation-adjusted invoice values

In short, there’s a lot to consider, so it pays to have the right tools at your disposal to get your costs right.

Our inflation-adjusted invoice calculator makes it easier to determine the impact of inflation on current and future invoices.

The calculator uses the CPIH index to determine how much prices have changed between the contract date and the invoice date. It then adjusts the invoice value accordingly.

Preparing for the unexpected

Fresh Projects project management software for architects gives you the financial management tools you need to maximise the profitability of your projects.

To find out more about how Fresh Projects can help you budget successfully and handle other project challenges, book a 30-minute demo today.